April 2024 Investment Commentary

It is understandable that U.S. investors want to maintain a home bias given strong outperformance and higher profitability of U.S. large caps. But there are growing concentration and valuation risks with maintaining a U.S. home bias which can be mitigated by expanding the home-front and investing beyond the concentrated U.S. large cap indices. We believe a broader breadth of investment opportunities exist internationally, and even within the U.S. home market, where investors need not sacrifice quality for more market diversity and less expensive valuations.

U.S. Outperforming World Markets

U.S. Large Cap Stocks, as proxied by the S&P 500, have outperformed world markets since the bottom of the 2008-09 Great Financial Crisis through 2/29/2024.

- The cap-weighted S&P 500 Index has generated a total annualized return of 16.0% versus 8.6% for ex-U.S. developed markets (MSCI EAFE Index) and 7.4% for global emerging markets (MSCI EM Index).

- Despite the recent dominant performance of the largest stocks within the S&P 500, the equal weight index remains ahead of the cap-weighted index, returning 16.4% annualized over this period.

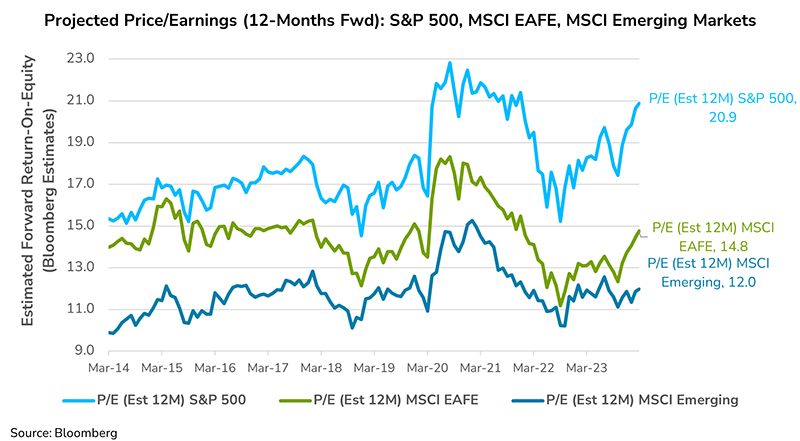

The outperformance of U.S. stocks over the rest of the world for the last 15-year period can be explained by the widened profitability gap (return-on-equity or ROE) of U.S.-based companies versus their international peers. With a diverse and highly profitable market to invest in, it is understandable why many U.S. investors maintain a U.S. home bias in their equity programs. Yet, relative valuations, as measured by price/earnings multiples, have also widened between the U.S. and the rest of the world commensurate with the widening gap in profitability.

- The S&P 500 trades near 21x estimated next 12-month earnings (NTM), close to a 10-year high, versus 14.8x P/E for MSCI EAFE and 12.0x P/E for MSCI Emerging Markets.

- The U.S home bias is becoming more expensive to maintain as U.S. investors increasingly are having to pay up to invest in the best house in the global neighborhood as measured by profitability and growth potential.

Considerations and Current Investment Guidance

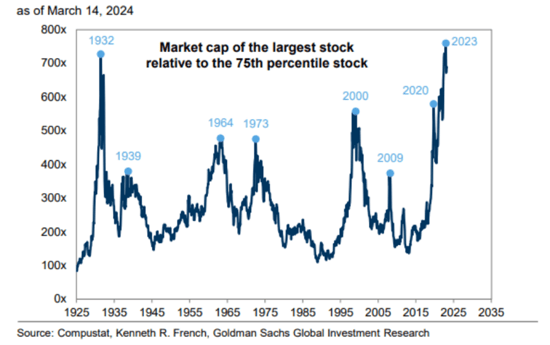

Investing in the S&P 500 translates into investing across a narrower, more concentrated market, dominated by a handful of companies and industries. The post-pandemic period has witnessed an increased concentration of market value assigned to a handful of mega-cap companies as the valuation gap between the largest companies relative to the rest of the market has grown to levels not seen since the Great Depression.

With the cap-weighted S&P 500 trading near cycle-peak valuations and a level of concentration that exceeds even that of the late 1990s Dot-Com Bubble, investors who want to maintain a U.S. home bias in their equity program should explore other opportunities across the U.S. market.

With the cap-weighted S&P 500 trading near cycle-peak valuations and a level of concentration that exceeds even that of the late 1990s Dot-Com Bubble, investors who want to maintain a U.S. home bias in their equity program should explore other opportunities across the U.S. market.

With an experienced team of highly skilled professionals, Freedom delivers full-service asset management solutions. We are proud to offer an institutional and systematic approach to each aspect of the investment process. From dedicated due diligence, asset allocation and capital market research, portfolio management, and portfolio operation specialist teams, the Freedom investment team is focused on curating the model marketplace so you can focus on your clients and your business.

Advisory services are offered through Freedom Investment Management Inc. (“Freedom”), a registered investment adviser. Investment strategies carry varying degrees of risk, including the total loss of principal. Freedom does not provide tax or legal advice.

While Freedom believes the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. This material reflects the opinions of Freedom and is an assessment of the market environment at a specific time. This is not intended to be a forecast of future events or a guarantee of future results.

This should not be considered a recommendation to buy or sell individual securities, nor should this information be relied upon as research or investment advice regarding any security in particular. Diversification does not ensure a profit or protect against loss.

Except as otherwise specifically stated, all information is as of March 26, 2024.