There is a popular saying that "two heads are better than one." When it comes to managing your clients' money, maybe more than two heads is even better.

Investors can find it a bit nerve-wracking to allocate half or even a quarter of their life savings to a single money manager or investment strategy. But with us, your hard-earned savings can be professionally managed by multiple institutional money managers. Employing multiple managers in different, non-correlating asset classes, styles and geographies can reduce risk, without sacrificing returns, in the long run.

Decreasing Risk

The idea that multiple money managers can reduce portfolio risk goes back at least three decades. Given that it is difficult for money managers to outperform consistently and that it is nearly impossible to predict which manager will outperform or underperform during any given period, wouldn’t it make sense to employ multiple managers to seek to reduce the risks?

According to early academic research published in the Financial Analyst Journal (FAJ) and the Journal of Portfolio Management (JPM), employing multiple money managers can reduce risk.(1)

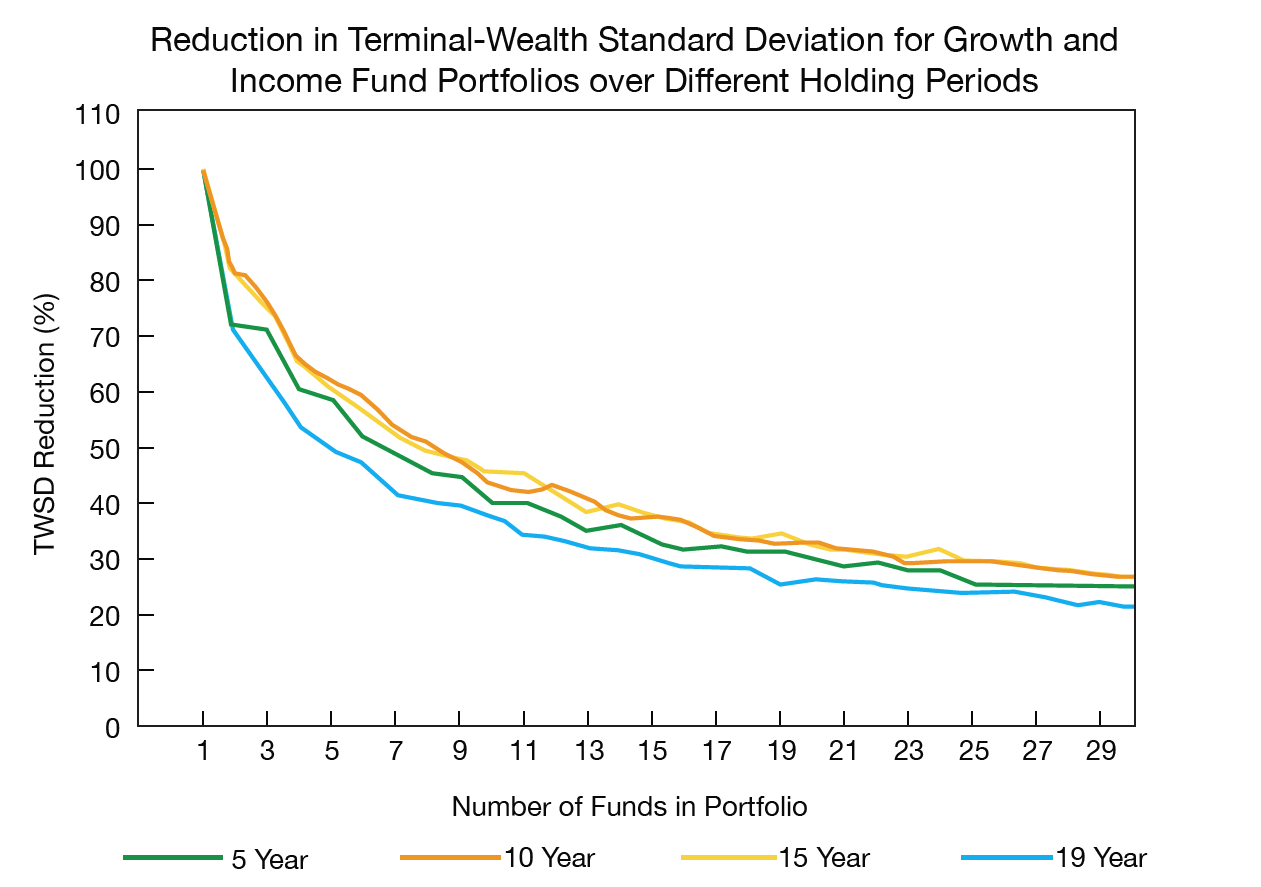

The figure shows that, in the sampling applied in the studies, Terminal Wealth Standard Deviation (TWSD)(2) of a portfolio, over a 5, 10, 15, and 19-year investment horizon was dramatically reduced when it was managed by multiple money managers. With as few as four to six managers, the risk was cut in half. However, after about twelve managers, the benefits of adding additional managers seemed to taper off.

Without Sacrificing Returns

There is an old adage that high risk can lead to high returns. Given that a portfolio with multiple money managers can have less risk, then does this mean it will suffer from less returns? Authors of an academic research paper published in the Journal of Investing (JOI) specifically sought to answer this question.(3) The JOI study finds that when a portfolio has 10 to 12 managers, the standard deviation of terminal wealth is about 60% lower versus a portfolio with a single manager of equities and a single manager of bonds. The investment horizons studied by the authors are 5-years and 10-years. Note that their risk reduction findings are similar to those in the FAJ and JPM studies.

Just as important, the JOI authors find that the risk reduction from using multiple managers “can be obtained without sacrificing expected terminal wealth levels, and hence without a reduction in total returns.”

Here’s a sample result from the JOI study: one dollar invested in a portfolio consisting of 50% equities and 50% bonds, managed by 12 managers, has $1.801 in it after 10 years, while one dollar invested in a portfolio with two managers has $1.796 in it after 10 years. Even though the terminal wealth of both portfolios is nearly identical, the portfolio with 12 managers had a standard deviation of terminal wealth that was 57.1% lower compared to the portfolio with two managers.

Overall, when a portfolio is managed by multiple money managers, it can reduce portfolio risk without sacrificing returns.

EQIS Models

We offer portfolio models spanning a variety of investment philosophies, including strategic, tactical, and income, across five risk categories, from conservative to aggressive.

Each model uses multiple money managers and strategies. This design is intended to seek a reduction in risk and to provide potential for good performance in the long run.

The managers used in the EQIS Models are initially screened by the Freedom Investment Team using a rigorous due diligence process, and managers chosen for our platform are additionally subject to ongoing due diligence reviews.

(1) O’Neal, E.S., 1997, “How many mutual funds constitute a diversified mutual fund portfolio?” Financial Analysts Journal 53, 37-46. Fant, L.F. and E.S. O’Neal, 1999, “Do you need more than one manager for a given equity style” Journal of Portfolio Management 25, 68-75.

(2) In the FAJ study, to calculate the baseline TWSD, a simulation is run 65 times, where a dollar is invested in a single fund. The terminal wealth at the end of the holding period is calculated by compounding quarterly returns for that fund over the entire holding period. The standard deviation of the 65 terminal-wealth levels is then calculated. Then, for comparison, TWSD is also calculated when a dollar is invested in multiple funds.

(3) Louton, D. and H. Saraoglu, 2008, “How many mutual funds are needed to form a well-diversified asset allocated portfolio?” Journal of Investing 17, 47-63.

Advisory services are offered through Freedom Investment Management, Inc. ("Freedom"), a registered investment adviser. Freedom does not provide tax or legal advice. The information contained herein is for informational purposes only. This is not an offer to sell securities or provide investment advice. Investment strategies carry varying degrees of risk to include total loss. The representations and opinions herein are the opinions and view of Freedom and are believed to be reliable but are not guaranteed by Freedom nor its affiliates. When applicable, sources used in forming Freedom’s opinion are cited, however, other sources may be available which contradict Freedom’s opinion, process, and methodology.